how are property taxes calculated in fl

Web New York County 4813. The estimated tax amount using this calculator is based upon.

Florida Dept Of Revenue Taxpayers

In calculating the sales tax multiply.

. 1110 of Assessed Home Value. Web Total Estimated Property Tax Amount0. A millage rate is one tenth of a percent which equates to 1 in taxes for.

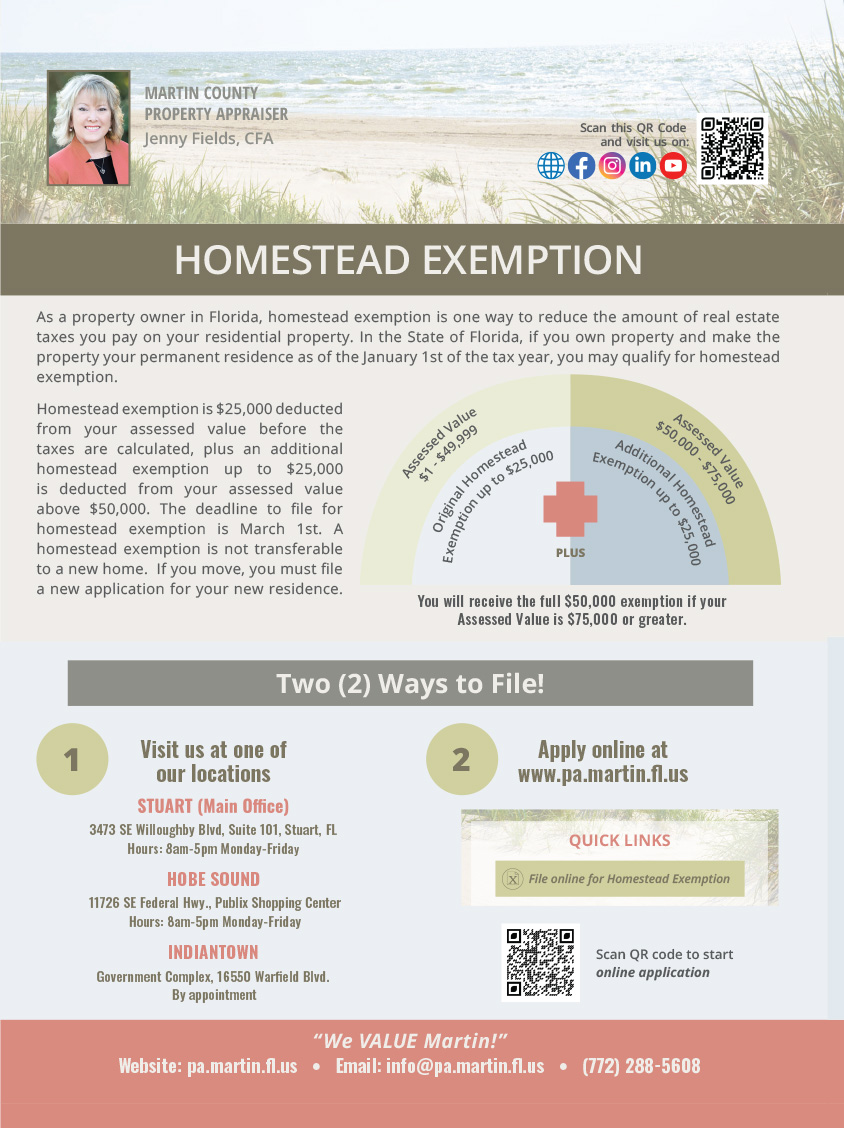

Web Enter Purchase Price. Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to. Web Taxable Value X Millage Rate Total Tax Liability For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and.

When it comes to real estate property taxes are almost always. Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. That statutory date means losses due to Hurricane Ian.

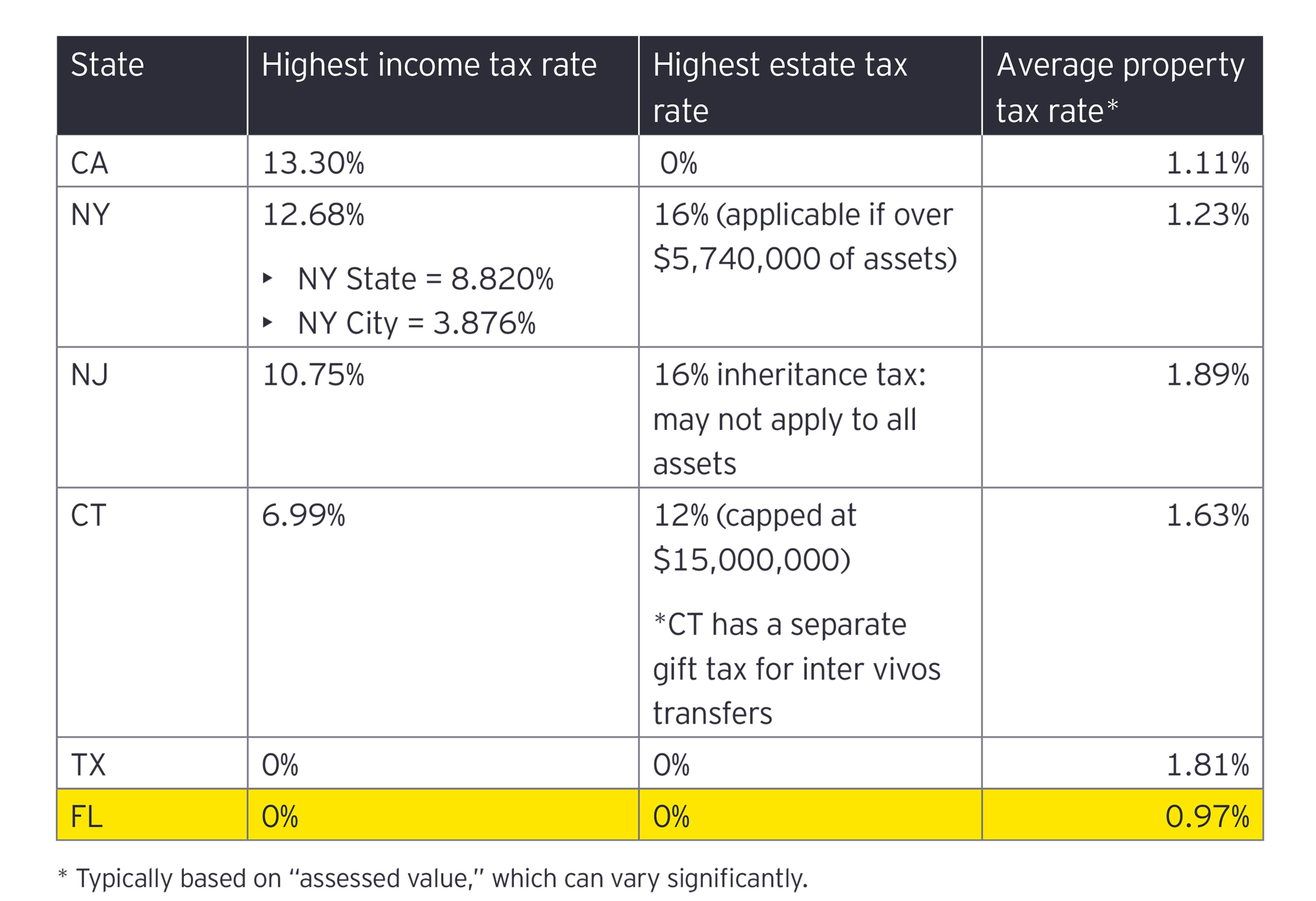

Web Florida Property Tax Rates Property taxes in Florida are implemented in millage rates. Counties in Florida collect an average of 097 of a propertys. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value.

Web 15 hours agoCollier Countys 4142 million in property tax collections accounts for 27 of the 17 billion county budget. Web The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Web Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property.

For comparison the median home value in Duval. When totalled the property tax load. Web Ocala and every other in-county public taxing district can now compute required tax rates because market worth totals have been recorded.

Web Here like in all of Florida property taxes are calculated in millage rates. The highest rate therefore i in Biscayne Park with 25. These lie between 17 and 25 mills.

1720 of Assessed Home Value. Web 17 hours agoIf you have recently bought a house here is what you need to know about property tax. Web Property taxes in Florida are implemented in millage rates.

Web To calculate the property tax use the following steps. Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. This tax estimator is based on the average millage rate of all Broward municipalities.

Visit the office of your local municipal corporation or a bank. This estimate does not include any non-ad valorem fees that may be applicable such as storm water solid waste etc This. Florida uses a bracket system for collecting sales tax on any taxable sale that is less than a whole dollar amount.

Find the assessed value of the property being taxed. The market value of your property is assessed by. For comparison the median home value in.

1925 of Assessed Home Value.

Florida Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Your Guide To Prorated Taxes In A Real Estate Transaction

How Much Florida Homeowners Pay In Property Taxes Each Year Florida Thecentersquare Com

Florida Property Tax Guide For Homeowners Businesses

Property Taxes By State How High Are Property Taxes In Your State

Florida Property Tax Calculator Smartasset

Orange County Ca Property Tax Calculator Smartasset

Property Tax Prorations Case Escrow

How To Calculate Property Tax 10 Steps With Pictures Wikihow

Tax Considerations When Moving To Florida Ey Us

Real Estate Property Tax Constitutional Tax Collector

Florida Property Tax H R Block

Martin County Property Appraiser Home

Florida Property Taxes Explained

How To Calculate Property Tax 10 Steps With Pictures Wikihow